Introduction: The Two Pillars of Renters Insurance Protection

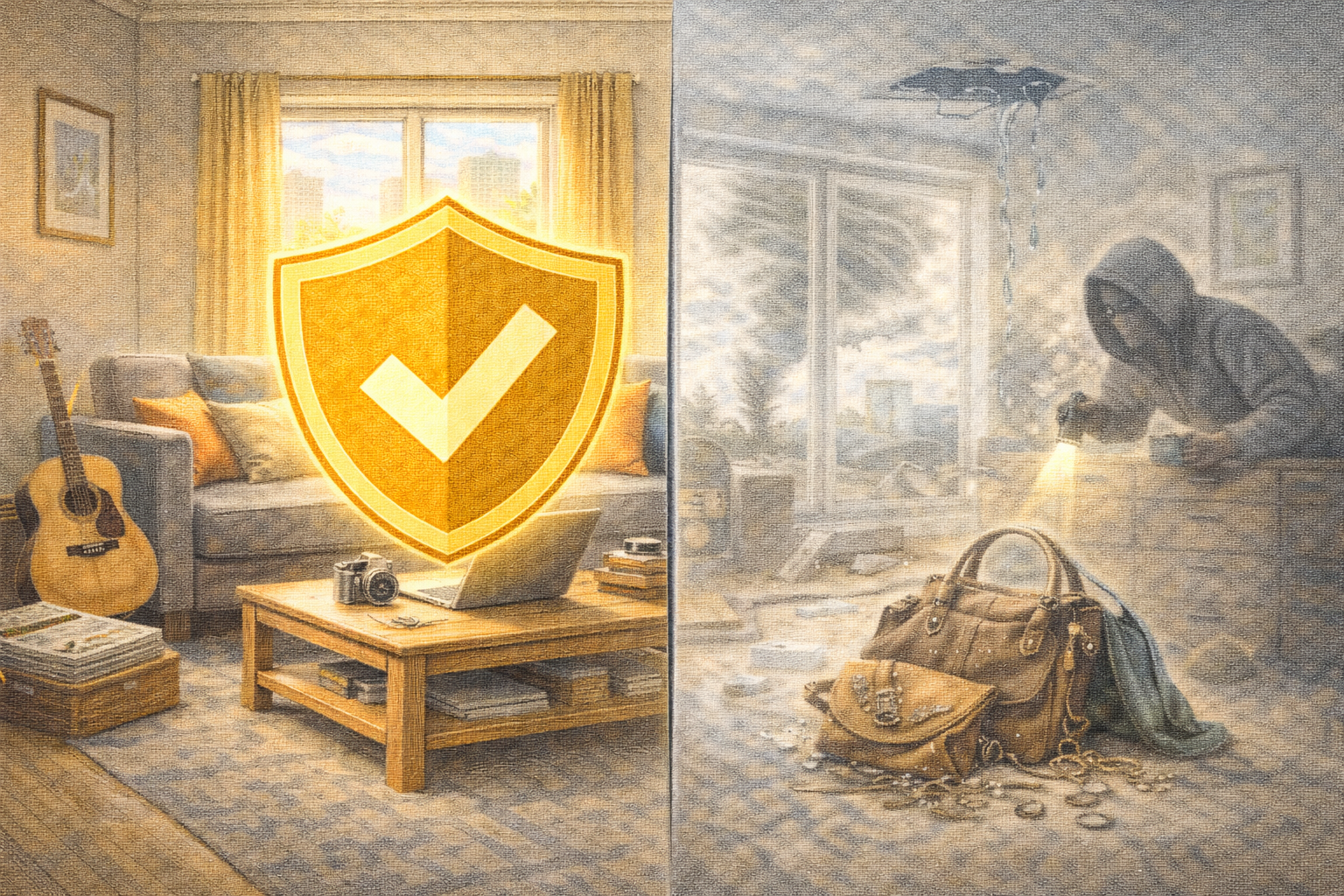

Renters Insurance is often misunderstood as a simple policy that covers belongings inside a rental unit. In reality, its value extends far beyond replacing damaged or stolen items. The two most critical components of any Renters Insurance policy are personal property coverage and personal liability coverage. Together, these protections safeguard renters from both material losses and legal or financial exposure.

Understanding renters insurance for personal property and liability is essential for U.S. renters who want comprehensive protection against everyday risks, unexpected accidents, and potentially devastating lawsuits.

Understanding Personal Property Coverage in Renters Insurance

Personal property coverage insures the renter’s belongings against specific covered perils such as fire, theft, vandalism, and certain types of water damage.

Items Commonly Covered

-

Furniture and home furnishings

-

Clothing and personal items

-

Electronics and computers

-

Kitchenware and appliances owned by the renter

-

Sports equipment and bicycles

Even in modest apartments, the cumulative value of personal belongings can easily exceed tens of thousands of dollars, making this coverage a core component of Renters Insurance.

Replacement Cost vs Actual Cash Value

A key distinction in renters insurance for personal property and liability lies in how personal property losses are reimbursed.

-

Actual Cash Value (ACV) accounts for depreciation.

-

Replacement Cost Coverage (RCV) reimburses the cost to replace items with new equivalents.

Although replacement cost coverage may slightly increase premiums, it provides significantly greater financial protection after a loss and is generally recommended for most renters.

Coverage for Property Away from the Apartment

Most Renters Insurance policies extend personal property coverage beyond the rental unit. Belongings may be covered when they are:

-

Inside a vehicle

-

Stored temporarily outside the apartment

-

Taken while traveling

This off-premises protection reinforces the value of renters insurance for personal property and liability as a comprehensive coverage solution.

Sub-Limits and High-Value Items

While personal property coverage is broad, policies often impose sub-limits on certain categories, including:

-

Jewelry and watches

-

Cash and securities

-

Firearms

-

Collectibles and fine art

Renters with high-value items should consider scheduling these possessions separately to avoid coverage gaps.

What Is Personal Liability Coverage?

Personal liability coverage protects renters if they are found legally responsible for bodily injury or property damage to others. This coverage is a critical yet often underestimated component of Renters Insurance.

Common Liability Scenarios:

-

A guest slips and falls inside the apartment

-

Water damage affects a neighboring unit

-

Accidental injury caused by a renter’s pet

-

Damage to common building areas

In such cases, renters insurance for personal property and liability can cover legal defense costs, settlements, and medical expenses.

Liability Coverage Limits and Legal Protection

Standard Renters Insurance policies typically offer liability limits starting at $100,000, with options to increase coverage.

Higher liability limits are particularly important in:

-

Multi-unit apartment buildings

-

Urban areas with higher litigation risk

-

Households with pets

Liability coverage often represents the greatest financial value in a renters insurance policy relative to its cost.

Liability Coverage Beyond the Apartment

Liability protection under Renters Insurance usually applies worldwide. Renters may be covered for incidents occurring:

-

Outside the apartment

-

While traveling

-

In public spaces

This broad scope reinforces the importance of renters insurance for personal property and liability as a general risk management tool, not just apartment-specific coverage.

Exclusions and Limitations to Understand

Despite its breadth, Renters Insurance includes important exclusions.

Common exclusions include:

-

Intentional acts

-

Business-related activities

-

Certain dog breeds or exotic pets

-

Vehicle-related incidents

Understanding these exclusions helps renters avoid false assumptions about coverage.

How Claims Work for Property vs Liability

The claims process differs depending on whether the claim involves property damage or liability.

Property Claims:

-

Require documentation of loss

-

Subject to deductibles

-

Limited by coverage caps

Liability Claims:

-

Typically no deductible

-

Insurer manages legal defense

-

Subject to liability limits

Knowing how renters insurance for personal property and liability responds to claims allows renters to prepare appropriately.

The Importance of Adequate Coverage Limits

Underinsuring either personal property or liability can expose renters to significant financial risk. Renters should periodically:

-

Update home inventories

-

Adjust coverage after major purchases

-

Reassess liability exposure

Balanced coverage ensures that Renters Insurance fulfills its protective purpose.

Enhancing Coverage with Optional Endorsements

Optional endorsements can strengthen renters insurance for personal property and liability, including:

-

Scheduled personal property coverage

-

Identity theft protection

-

Increased liability limits

These options allow renters to tailor policies to lifestyle and risk factors.

Comparing Policies for Property and Liability Coverage

When evaluating Renters Insurance policies, renters should compare:

-

Coverage limits and sub-limits

-

Deductibles

-

Policy exclusions

-

Claims handling reputation

Price alone does not reflect the true quality of coverage.

Common Mistakes Renters Make

Frequent errors include:

-

Assuming landlord insurance covers personal losses

-

Selecting minimum liability limits

-

Ignoring sub-limits for valuables

-

Failing to update coverage over time

Avoiding these mistakes improves the effectiveness of renters insurance for personal property and liability.

Conclusion: Comprehensive Protection for Modern Renters

Renters Insurance provides more than protection for belongings—it offers legal and financial security. By understanding renters insurance for personal property and liability, U.S. renters can make informed decisions that protect both their assets and their future income.

A well-structured policy delivers peace of mind, affordability, and broad protection tailored to the realities of renting in the United States.